Mint Vs Ibank Vs Quicken For Mac

Over the last several years, I’ve had the opportunity to try out a number of different budgeting systems, both for personal use and because readers have asked me to try them out. All of these options have the same goal: get control over your money. Where they vary is in their execution. Some allow you to directly import information from your banks, while others do not. Many utilize your computer, but a few do not. Some work on Windows, some for Mac, some on mobile devices, and some work on all three (and Linux, too).

Some are free, while others cost money. And, in the end, some options just work better than others. I’m often asked to recommend a single budgeting solution – and I will get around to that at the end of this article – but the truth is that there is no single budgeting solution that works best for everyone. Everyone has different needs. So, what I thought I would do is walk through some of the big questions I would ask myself when trying to decide on a budgeting solution and give some recommendations depending on what your answer is. I’ve boiled things down to three key questions to ask yourself when selecting one. Do You Trust Online Services with Your Bank and Credit Card Login Information?

In an effort to make things easier to use, many companies provide budgeting software that synchronizes with many of your financial accounts – your savings, your checking, your credit cards, your other debts, and your investments. These pieces of software will automatically pull in all of those transactions for you so that you can see all of that info in one place. This is incredibly convenient, but it does come with a price of sorts. You have to turn over your account information.

Most of these companies have an incredibly strong security policy, which makes them about as trustworthy as possible online, but you’ll have to make up your own mind as to whether it’s worth it. My Pick: Many people might have expected me to choose Mint here. While I think that Mint is a great piece of software, I feel like Personal Capital takes it to the next level. So, what’s Personal Capital. Personal Capital is a smartphone and web application that pulls together all of your account information and presents it in a single view for you to analyze.

You can build a budget, see how your spending actually matches that budget, and make adjustments in your own life accordingly. That sounds exactly like many other packages, so what sets Personal Capital apart? For me, it was how it handles investment and retirement planning. The software does a great job of helping you figure out your full investment picture far better than the other options I’ve tried. Of course, as with any free service, the makers of the software need some method of making money.

In Personal Capital’s case, their investment analytics provide a lot of encouragement to sign up with Personal Capital Advisors. I have no real opinion on their services as I never signed up, but I haven’t found a compelling reason to move away from Vanguard. Still, I’ve found that Personal Capital does the best all-around job of managing my finances and budget among tools that rely on sharing personal finance information. Alternative: Mint is easily the most popular tool in this space and it does an amazing job of organizing your finances. In terms of strict budgeting, it does at least as good of a job as Personal Capital. So what holds me back from making this my main recommendation? Their big method for earning money is that the software presents you with “offers” from other financial services, like banks and credit cards, which means that I’m presented with more things I don’t care about with Mint compared to other software options.

Also, I’ve had a worse experience with making my accounts sync with Mint than with Personal Capital. During my trial run with Personal Capital, I don’t recall a single problem with account syncing. Mint is probably a better all-around solution for people who have few investments and mostly just want to focus on keeping track of their expenses and income, given, of course, that you’re fine with sharing your account information with them. The Search Continues My answer to this question of trusting online services with my account info is no, I don’t trust online services with my login information. It’s not that I doubt their security – I fully believe that all of the services above use stellar security.

It’s simply that such services offer a single entry point to all of my financial accounts and that makes me extremely nervous no matter where that data is being kept. That data can be kept on the most secure server in the world and I wouldn’t like it. For me, at least, if I’m going to share significant personal data, I need to be getting something quite valuable in return, and in a world where there are lots of budgeting software solutions that do not require that type of information sharing, I’m just not getting enough value for me. Yes, I understand that my personal data is “already out there,” but that doesn’t mean it’s perfectly fine to share my info with yet another service. Not only that, I prefer to manually enter my expenses and income.

It keeps me mindful of all of that information. If I just automatically import it, I lose touch with each individual expense. Yes, sometimes I miss an expense or two, but I reconcile things with my account statements at the end of each month – again, it’s a way to keep me mindful. So, how secure do you want your system to be? Would You Prefer Your Budgeting System to Be Completely Off the Computer? Some people simply don’t want to trust any of their financial data to their computer.

Given the many security issues that are associated with online computer use, this can be a justifiable stance to take. Of course, people were budgeting and organizing their finances long before everyone had a computer on their desk. There are a lot of tools and great ideas for offline budgeting that work quite well.

I’ve tried several, but two stand out for me. My Pick: Envelope System The envelope system is simply brilliant because it takes the idea of budgeting out of a table of numbers and makes it very tangible. It works extremely well for people who prefer to operate in cash for many of their expenses, though it can work well with checks, too. Here’s how it works. You have a series of envelopes upon which you’ve written a particular money expense and an approximate dollar amount. So, for example, you might have a “Food – $75” envelope and a “Rent – $150” envelope. This generally works best if you base it on each paycheck.

So, for example, let’s say you get paid each week. Out of a given week’s pay, you’d need to cover a quarter of your rent, a quarter of your electric bill, a week’s worth of food, and so on. Out of your paycheck, you put an amount into each envelope equal to the dollar amount on the front. There are lots of ways to do this – you can use cash, you can use checks, or you can use paper slips. When I tried it, I used paper slips for most of the expenses and cash for some of them. So, what I would do is take my paycheck – let’s say it was $500 – and, from that, I’d put the written amount into each envelope.

$75 in the rent envelope. $40 in the electricity envelope. $60 in the food envelope. You get the idea. For the monthly bills, like rent, I’d just put in a slip of paper indicating the amount (like a IOU – you don’t actually have to use the paper slips, but it’s helpful).

For the other envelopes, like food and entertainment, I’d just withdraw the total amount from my bank account. I would never withdraw from my account other than that. Then, when I went grocery shopping, I’d limit myself to whatever was in the “food” envelope. When I wanted entertainment, I’d limit myself to whatever was in the “entertainment” envelope. At the end of the month, I would have enough left in checking to pay my rent and my electric bill and so on. This system works really well and it makes everything very tangible. If you want to tackle offline budgeting, this is a great system.

Alternative: Traditional Paper Budgeting Over the course of modern history, most people who have operated a monthly budget have done so by filling out a table by hand. You can find many of these online that you can easily print off for your own use –. A table-based paper budget is basically just a list of monthly income and monthly expenses. Each month, you calculate what you actually earned and spent and reconcile it with your budget. If you managed to stay within your budget, great! If you’re struggling in certain categories, you’ll see that pretty quickly, too. I consider this system a little more abstract than the envelope system.

If you run out of money in a category in an envelope system, you know it instantly – your envelope is empty. In a paper-based system, you might not know immediately that you filled up a particular category.

If you stay on top of things and keep the budget updated and keep on top of your spending, this isn’t a problem. Using a table like this works perfectly fine, but it does take time. This is a task that a personal computer was practically designed to aid with. However, as a tool, a table-based budget is a tried-and-true solution.

It will work. It has worked for many, many people over the last couple hundred years. It just requires focus and an attention to detail. The Search Continues For me, I don’t have a need to have a completely offline budgeting system. I’m not afraid to have the numbers themselves on my computer; it’s account numbers and login information that really worries me. The envelope system is great, but I’ve found that there’s computer software that does a great job of simulating the same thing with a lot of other features involved. We’ll get to that in a minute.

The next question to ponder is the question of “free.” Is “Free” a Make-Or-Break Factor When It Comes to Budgeting Solutions? For some people, sharing account info online is a non-starter, but they’re also not in a position to pay for budgeting software. They want a free computer-based solution where they don’t have to share their account information. This describes the situation I was in when I first started turning my financial situation around.

I was adamant about avoiding paying more than I had to for anything. I became a connoisseur of the free. For these folks, I have three recommendations. My Pick: The first money management software that I tried after starting my financial turnaround was the now-defunct Microsoft Money which came with my old computer.

I wasn’t particularly happy with it, so I started searching around for another solution – and I found PearBudget, which I used for quite a while. PearBudget is a spreadsheet with a bunch of automated elements written in. It works in spreadsheet programs like Microsoft Excel (if you have it) or the free (if you don’t). It takes an ordinary spreadsheet and pushes it about as close as possible to a full personal finance software suite, plus it’s still easy to use. Not only that, PearBudget is perfect for tinkerers. If you know spreadsheets – and I certainly do, as I had to use them professionally at various points – you can tinker with almost everything in PearBudget.

PearBudget is simply the best free solution for budgeting that I’ve found that doesn’t require account info sharing. It’s that simple. The only drawback is that it requires some familiarity with spreadsheet programs to use it. Alternative: PearBudget tends toward the minimal.

It’s not overly complex; it’s a spreadsheet, after all. Gnucash, on the other hand, is probably the most complex software on this list.

It actually can be used as small business software, though it certainly gets the job done for personal finance. It just does everything. You can make budgets. You can enter your investment info. You can make all kinds of projections for the future.

Even better, it’s open-source software, which means that the source code has been refined by a lot of programmers. It really does work well. The only drawback is that it’s a bit complicated to use. It’s like a Swiss army knife of personal finance software tools.

If you want a single package that manages your personal finances and your small business or side gig, go with Gnucash. It has a learning curve, but it’s incredibly powerful. The Search Continues My answer to this is no, free is not a make-or-break factor when it comes to budgeting solutions. I appreciate the simplicity of PearBudget and the power of Gnucash, but neither one really hits the sweet spot that I want. So What’s Left?

What about packages that don’t require you to share your data online and aren’t trying to sell you on other financial products? This is the category from which I chose a product; I’m willing to pay a little for a robust tool that keeps others out of my business (as much as possible). My Pick: You Need a Budget is the budgeting software I actually use. It stands out from the rest of the options for several additional reasons. You Need a Budget is focused on a clear budgeting philosophy.

Rather than just sitting there and generating reports for you, YNAB is all about helping you adhere to four “rules” of personal finance: Rule One: Give Every Dollar a Job Rule Two: Save for a Rainy Day Rule Three: Roll With the Punches Rule Four: Live on Last Month’s Income The philosophy makes a ton of sense and the software is almost perfectly designed to guide you toward it. More than any other piece of software on this list, YNAB is budget-centric. It just organically builds a budget that really works for you. Other software lets you create a budget, but it’s less tied to the realities of your life. YNAB requires you to enter your expenses manually. It has a mobile version which lets you enter those expenses on the fly (which I do). I use to share a save file between my desktop version and my mobile version so that when I open up either one, I have all of the current information from the other version.

I use for my own expenses. It’s the only software package on this list that I currently use. That’s the highest possible praise I can give it.

If you want to give it a shot, there’s a. Alternative: Quicken for Windows Quicken is the “old standby” of personal finance packages. It’s a desktop package that allows you to choose between downloading transactions from your bank or entering them manually. From that data, you can assemble a budget and make personal financial forecasts. It’s simply a solid, stable product that’s been around for many, many years.

There’s also a mobile version (if you’ve chosen to link Quicken to your bank accounts) that allows you to label your transactions on the fly. The biggest difference between Quicken (and iBank, which I’ll discuss below) and You Need a Budget is that You Need a Budget takes a “budget-first” approach. Quicken is probably better at purely tracking income and expenses, but You Need a Budget shines (for me) because it’s built to encourage you to live by a budget. If you just want to track expenses and income, go with Quicken and not You Need a Budget.

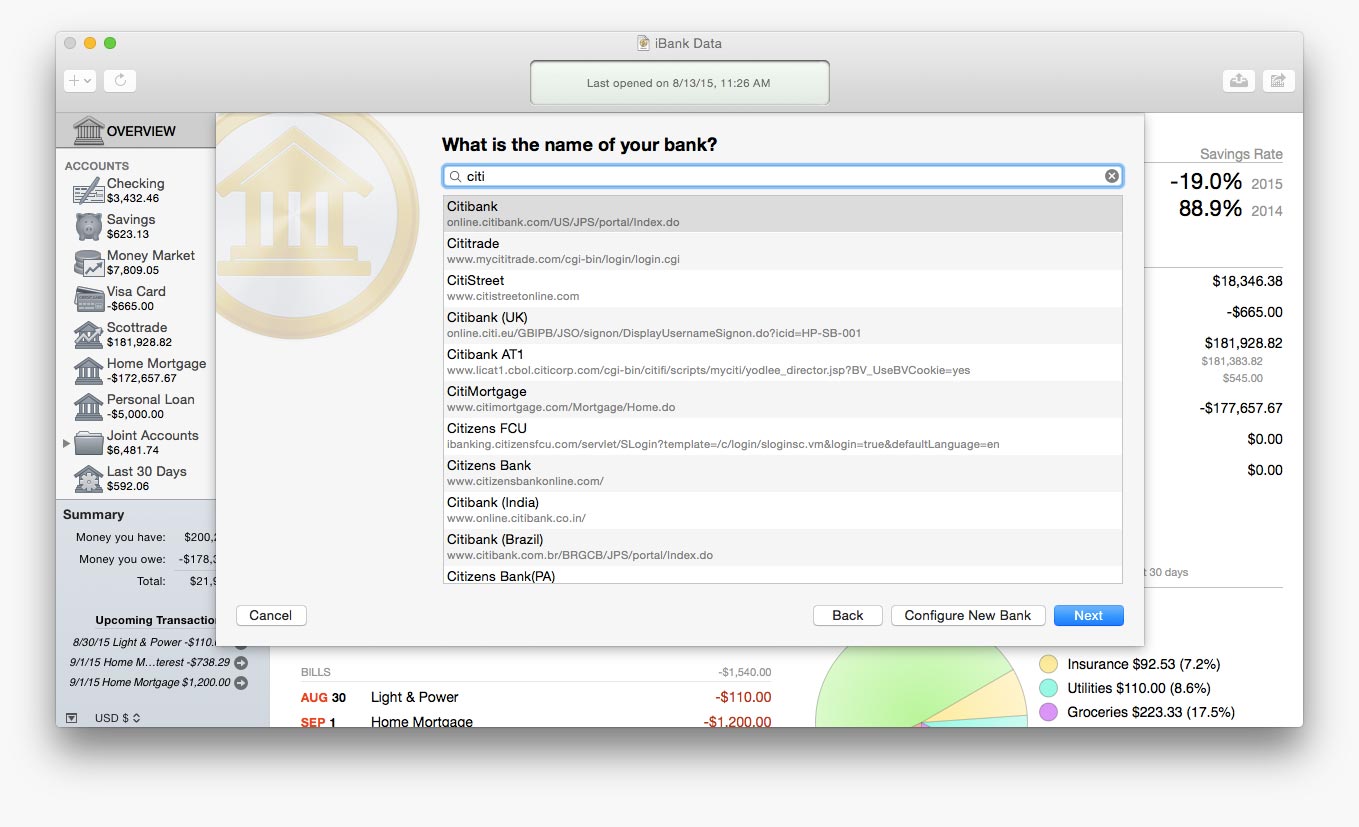

Alternative: iBank for Mac If you want to try Quicken but have a Mac, skip Quicken. Their Mac version isn’t very good.

Instead, try iBank, which is pretty much what Quicken should be on the Mac. It matches the Windows version almost feature for feature and, like the other options here, offers a slick mobile version if you wish to use it that allows you to enter transactions and synchronize them easily.

If you just want to track expenses and income on a Mac, go with iBank. Final Thoughts As you can see, there is no “best” software for your personal finance needs. You Need a Budget happens to match my own needs the best, but you may find yourself with different answers to the questions above which will lead you to different packages that will work best for your situation. None of the packages listed here are bad choices – they’re all good choices. I’ve intentionally not mentioned several packages I consider poor options (as well as packages I’ve never tried).

It simply comes down to the fact that different software solutions will work different for different people. A budgeting system can change your financial life. It’s certainly changed mine. Advertising Disclosure: TheSimpleDollar.com has an advertising relationship with some of the offers included on this page. However, the rankings and listings of our reviews, tools and all other content are based on objective analysis.

The Simple Dollar does not include all card/financial services companies or all card/financial services offers available in the marketplace. For more information and a complete list of our advertising partners, please check out our full.

TheSimpleDollar.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product's website. All products are presented without warranty.

What do y'all think about waiting for QFL or purchasing iBank now? I'm currently using Quicken 2006, and it's getting by, but it's slow and clunky (and I want something new to play with). If iBank wasn't so expensive, I might just buy that now, and would consider QFL when it launches (if it ever does).

For $60, that's pretty close to what QFL will be. The reason I'm not considering any of the other apps are that the ones I've tried don't download transactions. It's kind of a requirement for me right now, although once I get these darned credit cards paid off, I probably won't need it, since my bank doesn't support it. Edit: What do y'all think about Quicken online? I just noticed that's now an option. Has anyone used it? This is actually a question I'll be trying to answer once I get a macbook, currently I'm holding out for the refresh.

Mint Vs Ibank Vs Quicken For Mac 2018

Has there been any news on when Quicken Financial Life is actually going to be released? I read up on it a while ago and like the idea that they're doing a complete revamp and actually tailoring it for OSX instead of being a subpar port of the Windows version (from what I've read).

Be interested in knowing if they've got a release time set or if its still just fall of '08. But yeah, ibank seemed really to be the only other decent contender for being able to do budgeting/household finances and follow a portfolio of investments. I'm setting my stuff up for Quicken Online right now. So far, it's kind of neat. And at $3/month, it'll be 2 years before I start losing money as opposed to buying a software package. On their site, it still has Fall 2008 for Quicken Financial Life.

They're also saying that Quicken Online supports IE, FF, and Safari browsers, and mention that you can check it at any computer or your iPhone. I think they're really trying to support Apple, but their old programs were just too clunky for the Intel Macs and they wanted to start over and do it right.

I'm really not sure what the difference their huge program has over the less than 10MB download for iBank, Money, Moneydance, and the like. Being a Quicken/Microsoft Money user for almost 10 years, it's hard for me to switch. Click to expand.Thanks for this suggestion. I didn't even know Quicken had an online version. It's perfect because my wife likes to hold onto the checkbook and I hate having to call and find out if we have money in the account. This way we both can monitor and update the account as needed.

I would like to see the addition of a Bill Pay option. I'm actually surprised this feature hasn't been implemented yet. But for $3/month I can't really complain.

It's nice just to be able to stay current with our accounts. I'm also in the market for personal finance software, nothing too fancy needed. Just household budgeting, CC management, checking account and a 401k.the basics pretty much.but I would like to utilize downloading of account info and have it inputed into whatever financial software I use. I see there are a few people recommending ibank. I've done some searching/reading and there were plenty of mediocre to poor reviews for ibank so I had crossed it off my list of possibilities (that can change I guess).

Moneydance seemed to get good reviews and does the downloading of account info that many of us desire. Does anyone have knowledge/experience with the current version of moneydance? I have pretty much ruled out the current Intuit products because of the seemingly overwhelming poor reviews on either their products, service and/or business vision. Guess I'm still feeling my way around looking for the right (for me) personal finance software. I'll be following the thread with great interest to see what light you guys can shed. Thanks in advance.

Click to expand.I'm a current Moneydance user. I use it for a simple bank account and I 'manipulate' it using sub accounts to do envelope budgeting. Its java, been around for ages and fairly mature. The GUI is a bit finicky though but it performs its job well and is quite feature full.

I don't use it for online though (no online connections with any Australian bank) so can't comment on that. IBank I thought was ok in version 2 if a little buggy. With v3 the developers chose to glam it up with coverflow and other such nonsense rather than concentrate on finance functionality. Another I think is pretty good is LiquidLedger. It doesn't do online but its got loads of features with a pleasant and straightforward interface.

Worth checking out. The data file is uploaded to your MobileMe/.Mac account, or whatever you want to call it. Then when you access it via your iPhone you log onto your iDisk through https, and then it presents the file as a web app. From there you see your balance, and you can 'touch' your balance to enter in transactions. It then saves the transactions to update your balance. You can sync this data within iBank between your desktop data file and the 'iPhone' file saved on your iDisk.

I hope that helps in understanding the function. Click to expand.I hope Quicken Financial Life is powerful program that is compatible with Quicken and MS Money data. But there's little information on it and the early previews suggested it's going to be a lightweight app. Until it comes out, or something better, I use MS Money in Parallels / WinXP. I've been doing personal finance for 15+ years, and about ten of those in MS Money.

And I hope to keep doing so, with my records for the next 10 or 20. So as long as possible, I need an application that can read Money (or Quicken) data - and can export it if I need to change applications. I've not heard that any of the indy finance apps are Money or Quicken compatible or have anywhere near the same feature set. If they are in the same league, I'd love to hear it.